Meetings: Insurance

In this, and the following sections, we take you through the agenda of a strata corporation AGM.

Insurance

Insurance, this item follows the appointment of officers. An extract from our pro-forma minutes follows…

Legislation

Building Insurance: See common property insurance page

Public Liability Insurance: See public liability insurance page

Other Insurance: See other insurance page

Owners rights: See insurance – owners rights page

Insurance:

This item follows the appointment of officers on the agenda. An extract from our pro-forma minutes follows:

Section 103 of the Community Titles Act 1996 imposes a duty on the Corporation to insure all building and building improvements on the common/community property for their full replacement value, including all costs incidental to and associated with their replacement.

The Corporation is further required to keep itself insured against liability for negligence/bodily injury ($10,000,000 minimum) and against any other liabilities [eg: flood, office bearer liability, catastrophe] determined by a special resolution of the Corporation.

The Corporation’s current policy details are as follows:

Underwriter: _________________________________________________

Renewal Date: _______________

Building: $ ______________

Excesses: $ ______________

Loss of Rent/Alternative Accommodation $ ______________

Common Contents: $ ______________

Legal Liability/Public Liability: $10,000,000 / 20,000,000

Volunteers: $ ______________

Fidelity Guarantee: $ ______________

Office Bearers Liability: $ ______________

Catastrophe: $ ______________

Cover to Remain the same: It was agreed that the insurance covers will remain the same.

OR

Renewal to Management Committee: It was agreed that the insurance renewal be forwarded to the Management Committee for consideration.

OR

As Suggested by the Insurance Company: It was agreed that the insurance cover be increased, at renewal by the amount suggested by the insurance company.

OR

Obtain Quotations: It was agreed that quotations be obtained for cover of $________________ before the renewal, and sent to the Management Committee for a decision.

OR

Cover to be Changed: It was agreed that the property cover be $________________ and that legal liability cover of $10,000,000 / $20,000,000 be retained.Moved____________ / Seconded ____________ Motion carried.

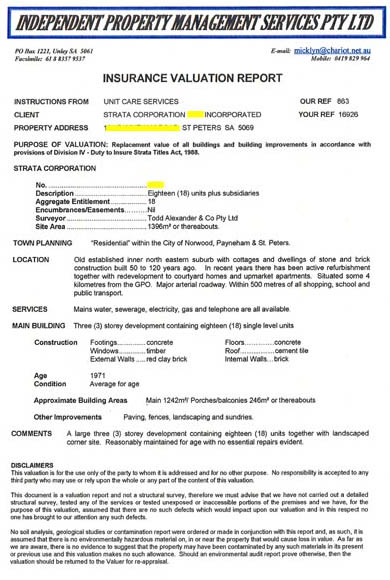

Insurance Valuation: It was noted that there was no valuation on file.

OR

It was noted that the most recent valuation was on ____________ for $_______

AND/OR

Insurance Valuation: It was resolved to engage the services of a certified practicing valuer to prepare an insurance valuation report (replacement value) that will be forwarded to the Management Committee for a decision.

OR

Insurance Valuation: It was noted that there was no valuation on file.

OR

Insurance Valuation Defer: It was agreed to defer engaging the services of a certified practicing valuer.Policy – Insurance Excess Payments: It was resolved that the owner will pay the insurance excess on any insurance claim to do with the property of the owner. The Corporation will pay the excess on any claim related to the common property.

The unit owner has a right of written appeal to the Management Committee.Moved____________ / Seconded ____________ Motion carried.

Commissions: It was noted that the manager receives a commission if the Corporation’s insurance is placed with ______________________________

Home/Contents Insurance: It was noted that it is necessary for unit owners to individually arrange for adequate insurance for any buildings erected upon their respective units, as well as the contents of their homes. This is includes carpets, drapes, light fittings, etc., whether or not the home is occupied by the unit owner or a tenant. Such items are not included in the Corporation’s insurance policy.

Hint

As the chairperson ensure you have:

- have a copy of the current insurance certificate at hand along with copies for all those attending

- if a quote(s) is available then have sufficient copies for all present

- ensure everyone understands the importance of a comprehensive insurance policy that covers the legislative requirements, along with protection for officers and volunteers.

Best Practice

Valuations: It is strongly recommend that all Community Corporations obtain a professional replacement valuation at least every 5 years. If your group refuses to do so we recommend that this refusal be noted in the meeting minutes – this might include the names of those in favour and those against. In this case, if a group is underinsured, you have done your best to alert them to the need for a valuation. By doing this, the owners voting against the proposal have knowingly accepted liability. See Insurance Valuations page.

Tools

The following may be of assistance.

|

Meeting Minutes Pro forma |

Three Laws of Meetings |

Meeting Manage Video |

|

Meeting Hints Sheet |

Meeting Procedure Rules |

Link to next step – Maintenance