Insurance: Valuations

Best Practice

Valuations: It is strongly recommended that all Corporations obtain a professional replacement valuation at least every 5 years. If your group refuses to do so we recommend that this refusal be noted in the meeting minutes, this might include the names of those in favour and those against. In this case, if a group is underinsured, you have done your best to alert them to the need for a valuation. By doing this, the owners voting against the proposal have knowingly accepted liability.

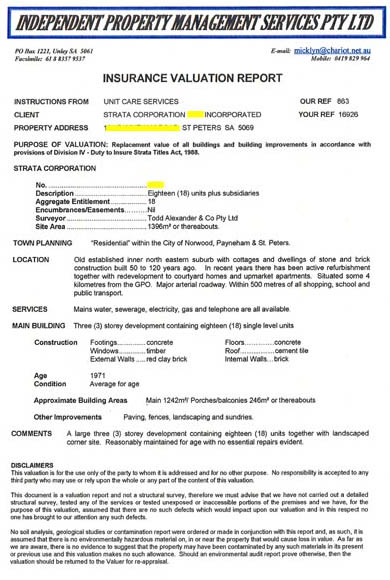

The following is an example of a professional valuation for a strata corporation. It was undertaken by a qualified valuer and it is based on the cost to replace the group. (click on the images below to enlarge)

In this case, the valuer visited the property and inspected a representative sample of the units. The valuation includes Main buildings, Carports/Garages, Improvements, Demolition costs, Council & Architect fees and GST (Goods & Services Tax).

We use and recommend Michael Hadley & Associates 0419-829-964

Note: Under the Strata & Community Titles Acts all owners are jointly and severally liable for any shortfall in the common property building sum insured when reinstating the building(s).

If a manager or officer fails to alert owners to the need for a valuation or is aware that the group is insured well below the average expected, then the Corporation and its officers may be considered negligent.

In professionally managed groups owners rely on their manager for sound advice, with the expectation that they will look after their best interests at all times.