Insurance: Common Property -Strata & Community Title

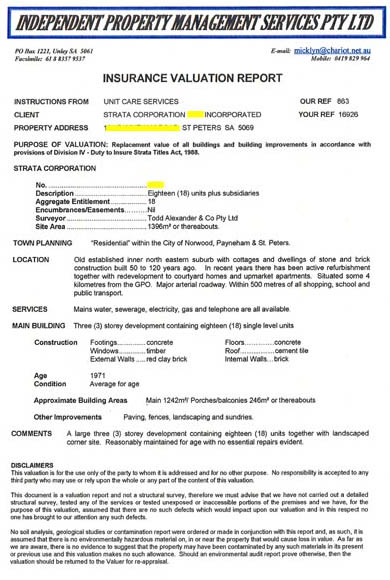

Strata Titles Act (plan number less than 20,000)

Building Insurance: What does the Strata Titles Act require?

Section 30 of the Strata Titles Act spells out the insurance related responsibilities of a Strata Corporation.

Section 30: Insurance

(1) A strata corporation must keep all buildings and building improvements on the site insured to their replacement value.

(2) The replacement value of buildings and building improvements is the cost of their complete replacement including the cost of any necessary preliminary demolition work, any necessary surveying, architectural or engineering work and any other associated or incidental costs.

(3) The insurance must be against –

(a) risks of damage caused by events (other than subsidence) declared to be prescribed events in relation to home building insurance under Part 5 of the Insurance Contracts Act 1984 of the Commonwealth; and

(b) risks against which insurance is required by the regulations.

(4) Any money to which a strata corporation is entitled under a contract of insurance in relation to damage to buildings or building improvements must, subject to any contrary order of the Court, be applied by it in reinstating or repairing those buildings or building improvements.

What does this mean?

Buildings: All common property buildings must be insured, this includes:

- the walls and floors (excluding the owner’s contents)

- the boundary fences, including those between the units

- roads

- the electricity, water supply and sewer

- the inside of units including the owner’s walls

- all of the fixtures and fittings inside the units such as: kitchen cabinets, tap ware and benches, fixed air conditioners which are considered to be part of the building.

Community Titles Act

Building Insurance: What does the Community Titles Act require?

Section 103 & 104 of the Community Titles Act spells out the insurance related responsibilities of a Community Corporation.

103—Insurance of buildings etc by community corporation

(1) A community corporation must insure—

(a) the buildings and other improvements (if any) on the common property; and

(b) in the case of a strata scheme—the building or buildings divided by the strata plan. Maximum penalty: $15 000.(2) The insurance—

(a) must be against risks that a normally prudent person would insure against and risks that are prescribed by regulation; and

(b) must be for the full cost of replacing the buildings or improvements with new materials; and

(c) must cover incidental costs such as demolition, site clearance and architect’s fees.(3) In the event of a claim, any excess or shortfall resulting from under insurance must be met by the corporation.

104—Other insurance by community corporation

(1) A community corporation must insure itself—

(a) against risks that a normally prudent person would insure against; and

(b) against such other risks as are prescribed by regulation. Maximum penalty: $15 000.(2) The amount of the insurance must be the amount that a normally prudent person would insure for but in the case of bodily injury must be at least ten million dollars or such greater amount as is prescribed by regulation.

What does this mean?

Strata Division – one lot above another

Buildings on community titled Strata Divisions are treated the same as a Strata Titled group. The corporation owns the buildings..

Buildings: All common property buildings must be insured, this includes:

- the walls and floors (excluding the owner’s contents)

- the boundary fences, including those between the units

- roads

- the electricity, water supply and sewer

- the inside of units including the owner’s walls

- all of the fixtures and fittings inside the units such as: kitchen cabinets, tap ware and benches, fixed air conditioners which are considered to be part of the building.

For regular lot by lot Community Corporations each lot owner owns all buildings on their respective lots and therefore their insurance. If a wall is shared (party wall), such as with a townhouse, the two lot owners share ownership and a duty to insure.

Hint

Check the By Laws as they often mention insurance.

Some lot by lot (non strata division) groups save considerable money by insuring collectively.