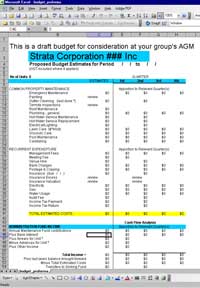

Budget

Community Titles Act

Section 114—Contributions by owners of lots

(1) A community corporation must, in general meeting, fix the amount it requires by way of contributions from the owners of community lots.

(2) The amount must be fixed by an ordinary resolution of the corporation and not by the management committee.

(3) Subject to this Act, the share of an amount fixed under subsection (1) to be contributed by the owner of each lot is proportional to the lot entitlement of the lot unless otherwise provided by a unanimous resolution of the corporation.

(4) A corporation may, by ordinary resolution—

(a) permit contributions to be paid in instalments specified in the resolution;

(b) fix (in accordance with the regulations) interest payable in respect of a contribution, or an instalment of a contribution, that is in arrears.(5) A contribution, or an instalment of a contribution, is payable on the day specified for payment in a notice served by the corporation on the owner of the lot.

(6) The notice must—

(a) include information required by regulation; and

(b) be served on the owner at least 14 days before the date for payment.(7) Payment of a contribution, instalment or interest is enforceable jointly and severally against the owner or owners of the lot and the subsequent owner or owners of the lot.

(8) A contribution, instalment or interest may be recovered as a debt.

(9) Where a leaseback arrangement is in force, the lessee and not the owners of the lots that are subject to the leases comprising the leaseback arrangement must pay the amount of the contribution.

(10) If the community corporation carries out work at the request, or with the consent, of the owner of a lot and the work wholly or substantially benefits that lot to the exclusion of the other lots, the corporation may, subject to any agreement to the contrary, recover the cost of that work as a debt from the owner of the lot.

(11) Where a debt referred to in subsection (10) is recoverable from the owners of two or more lots, they are liable jointly and severally for the debt and are entitled to contribution amongst each other in proportion to their respective lot entitlements.

(12) An amount paid by a person under this section is not recoverable by the person from the corporation when he or she ceases to be the owner of the lot.

Community Titles Act

Section 116—Administrative and sinking funds

(1) A community corporation must establish an administrative fund and a sinking fund.

(2) Subject to subsection (3), non-recurrent expenditure 1 must be made from the sinking fund and all other expenditure of the corporation must be made from the administrative fund.

(3) Expenditure must not be made from a fund to satisfy a financial or other obligation to the owner of a lot who cannot be required to contribute to that expenditure 2 or to pay legal costs that the owner of the lot cannot be required to contribute to 3, if the expenditure, or part of the expenditure can be traced to a contribution made by the owner of the lot directly or, where he or she is the owner of a secondary or tertiary lot, by way of a contribution made by the secondary or tertiary corporation.

(4) Subject to this section, contributions of owners of lots and other money 4 received by a corporation must be credited to the administrative or sinking fund according to the purpose for which the money will be used.

(5) Money received on sale of assets of a corporation must be credited to the sinking fund.

(6) All money to be credited to a fund must—

(a) be paid into an account in the corporation’s name at an ADI or at any other financial institution prescribed by regulation; or

(b) if the corporation has delegated its power to receive and hold money to another person, be paid into a trust account held by that person at anADI or at any other financial institution prescribed by regulation.

Notes:

1 Non-recurrent expenditure is expenditure for a particular purpose that is normally made less frequently than once a year. See the definitions of recurrent and non-recurrent in section 3.

2 See section 115(1).

3 See section 115(3).

4 For example, an insurance claim or income received from investment of the fund.