Insurance: Claims – Strata & Community Corporations

This is the time when your Corporation finds out what your insurance policy is worth.

Making an insurance claim:

Step 1. Report the damage.

Contact your manager/group Secretary or the insurance company. The earlier you file a claim, the sooner an adjuster will look at the damage. Be prepared to provide:

- Details of the loss – we suggest you make notes at the time of the loss.

- Policy holder name – your Corporation

- Address of the group

- Police report numbers such as in the case of vandalism or malicious damage

- Policy number – look at your group’s insurance renewal or certificate

- Date and time of loss

Please note that for small claims the insurance company may authorise the Corporation to undertake the work and forward bills with a claim form.

Hint

Some insurance companies do not require a claim form. This is the case with CHU Insurance. Check with your insurance company.

Hint

If you are a manager and are in doubt about a claim submit it to the insurance company and let them decide.

Step 2. Protect the group from further damage.

All policies require the Corporation to take steps to reduce the risk of further losses. To this end the Corporation should temporarily repair roofs, cover broken windows with boards or plastic, and move common furnishings exposed to the weather to a safe location.

Step 3. Keep accurate records.

Make a list of all cleaning and repair bills, this includes materials and the cost of any rental equipment. List all actual losses regardless of whether you intend to replace them. Document the value of each object lost.

Step 4. Initiate repair work.

Contact a reputable, well-established firm or individual to repair the damage. Get written contracts for the work. Recognize there are disreputable people who try to take advantage of Corporations following a loss. Some insurance companies will arrange for their own contractors to attend.

Hint

Ask your group’s insurance company if they have preferred contractors who will undertake the repairs. This will take the pressure off.

Step 5: Insurance Excesses – whos pay?

Many insurance policies now include an excess. This usually applies to claims against the building cover. The amount can vary between $100 and $1000 and sometimes more. Unless your Corporation has a policy the group will pay the excess when an owner’s property is involved eg: water damage from a leaking shower. See Best Practice below.

Step 6. Claim form.

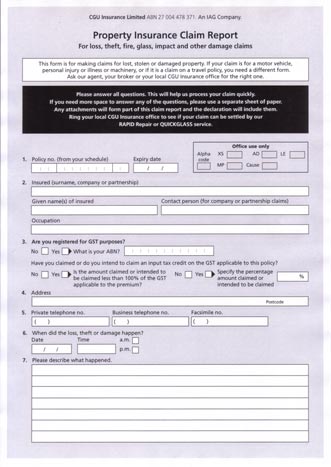

To recover the costs lodge an insurance claim. Often this will involve filling in a form such as the one below.

The accounts for repair works will need to be attached along with the details of any report to the Police in the case of burglary or vandalism.

Note: CHU do not require a claim form to be filled out just ring 1800 022 444 (all hours) or your manager. Check with your insurance company first.

Hint

Write a reminder for two weeks time to check if the insurance company has honoured the claim.

Best Practice

Suggested Policy – Insurance Excess Payments:

It was resolved that any insurance claim that is to do with the property of the unit owner, the unit owner will pay the insurance excess. Any claim related to the common property, the Corporation will pay the excess.

The unit owner has a right of written appeal to the Management Committee.